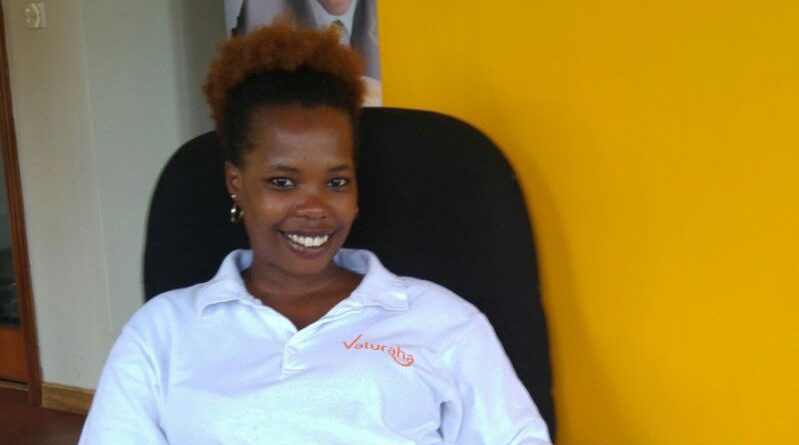

Tell us about yourself and your professional journey?

My name is Wangechi Mwangi, I’m 22 years old and a student at Strathmore University. I started my first project when I was 17, which was a community-based program. We got young people together and built a social network platform and through that we did community-building activities, like mentoring students from under-privileged backgrounds, visiting hospitals and visiting children’s homes.

After that, at 18, I got an internship at iHub Research, an innovation hub for the tech community in Kenya. I was doing research on two main things; firstly, the technology and entrepreneurship space in Kenya and secondly, the impact groups like hubs and accelerators have on entrepreneurship in Kenya.

Being at iHub straight after I finished high school really exposed me to the positive impact tech and entrepreneurship have on our development as a country. I really became interested and invested in this field. I joined Strathmore University shortly afterwards. I was still doing internships and projects while in school because I’ve always felt this hunger to do something more and go the extra mile. For my second-year project, I started Valuraha with a few of my counterparts and I left all my other projects to fully invest my time and energy in it.

Why did you choose to pursue a career in finance and technology?

I have always had a passion for finance and economics. However, my experience at iHub grew my interest in technology so I looked for ways to merge the two fields. I decided to enroll business and technology program at the university but the course had more to do with tech than finance so I wasn’t really satisfied. When the opportunity arose to do a project that had the perfect balance of tech and finance (Valuraha), I grabbed it.

Why Valuraha? What motivated you to start this organization?

I believe money is important, but understanding it is critical that it doesn’t control or have power over you. My observations over the years indicate that the more you plan your money and make it work for you, the more control you have over it, and the more independence you have over your activities later in life. Majority of Kenyans don’t have a good saving or investment culture, and Valuraha aims to change this by teaching the younger generation about how to attain financial independence, thus building a society of more financially stable individuals

What is your view of women’s participation in finance and tech space in Kenya?

From my experience working with high school students, I can say for the most part that both boys and girls are given equal opportunities and resources in terms of education. Exploitation of these resources is different though, and I have seen both boys and girls reaching out and taking advantage of these opportunities. The difference comes in at an individual level because some girls may not be interested in finance or tech, and to me that’s totally fine. I believe in giving people the freedom to pursue whatever their passion is, and giving equal opportunities to both boys and girls.

How does Valuraha empower the youth?

Valuraha offers young people a very different view of investments and entrepreneurship and exposes them to opportunities in these fields at a very young age. Our students buy shares while they’re in high school, so you can only imagine what they will be doing in college or when they’re working. We don’t necessarily teach the specifics of finance but we teach them basic skills in investments and wealth-building that enable them to see opportunities and resources where previously they would not have seen any. We also give them a chance to explore and be creative with the skills we give them so they end up teaching new things at the end of the day. I believe that nations are built by entrepreneurs and people who are constantly giving back, and that’s exactly what our club teaches the youth to practice.

In your view, what is the most significant achievement Valuraha has had up to date?

It’s not the recognition or awards we’ve received, it’s definitely the impact we’ve had on the young people we mentor. It’s the Faiths who won’t have to pay for university since they won a scholarship during our annual competition. It’s the Imandas who have investment portfolios of 150,000 Kshs at the age of 16. It’s the Traceys who have completely changed their family situation by converting their family members into avid investors. The small, but positive changes we make in our community, that’s the most significant achievement.

What are some of the challenges/setbacks you’ve faced?

One of the main challenges we have faced is when two of our co-founders left and I was left as the sole person running the company. I suddenly had to face the responsibilities of three people by myself and that took a toll, but I’d like to think that I grew out of it and learnt how to balance it all quite well. Revenue is also a problem at times as we don’t get enough funding from schools and we have to look at alternative sources of revenue. Poor infrastructure in schools is a major problem too, as we need computers and the Internet for the club but some schools don’t have these resources. In these schools though, we have pushed principals and external parties to provide the materials we need to run the club. This last setback actually turned into a positive thing though, as some schools that have never had any IT resources finally have something to work with. Challenges will always be there but I think we emerge from them as better and refined.

What do you see in the future of Valuraha or what do you hope to be in the future?

I would like the Valuraha program to be available in high schools all over Kenya, and to the extent of it being mandatory for each high school student. I want students to know that one doesn’t need an education in economics and business in order to be financially literate. I want them to be aware of themselves, at least financially.