UN Women, IFC and the International Capital Market Association (ICMA) launched, on November 16th, 2021, a new practical guide to using sustainable bond issuances to advance gender equality, entitled “Bonds to Bridge the Gender Gap: A Practitioner’s Guide to Using Sustainable Debt for Gender Equality“.

Gender inequalities persist in every country and society around the world but COVID-19 has revealed how the crisis has disproportionally affected women. With less than a decade remaining to achieve the 2030 Agenda for Sustainable Development, financing solutions that drive gender equality must be accelerated.

Global debt capital markets can play an important role in financing progress toward gender equality in both the public and private sectors. For issuers, these bonds offer an opportunity to lead on advancing gender equality, diversify their investor base, as well as to define and communicate their commitment to the market.

The guide provides both the public and private market useful information on how to use sustainable bonds to finance projects and strategies that advance gender equality and offers illustrative examples of gender-related use of proceeds, as well as key performance indicators (KPIs) and sustainability performance targets (SPTs) in the case of sustainability-linked bonds.

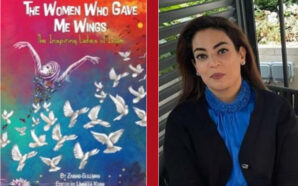

UN Women Executive Director Sima Bahous.

This guide will support the ecosystem of the debt market including new and existing bond issuers, borrowers, underwriters, arrangers, and external reviewers to take action to integrate gender equality objectives into sustainable debt products. It is also a resource for investors seeking to understand and support projects and strategies that are designed to advance gender equality.

“The achievement of gender equality and women’s empowerment, as embodied in Sustainable Development Goal 5, is critical for humanity to progress and realize its full potential. UN Women is proud to be working alongside capital market actors to ensure that financing from both the public and private sectors is sustainable and inclusive. This global guide is a foundational first step in this journey”, said UN Women Executive Director Sima Bahous.

Bryan Pascoe, Chief Executive, ICMA said: “We believe that bond markets have tremendous untapped potential to fund the advances in gender equality which are so essential for sustainable economic development. This new practical guide, based around the use of the established Social Bond Principles and Sustainability-linked Bond Principles, is an important step forward in encouraging issuers and investors to integrate gender into sustainable bond issuances and investment”.

Similar to the way in which the introduction of green bond standards and guidelines facilitated the growth of the green bond market and the development of a separate asset class, these global guidelines on gender will provide the support needed to capital markets to significantly increase the volume and quality of financing for gender equality and lead to lasting impact.

Makhtar Diop, Managing Director, IFC said: “With less than a decade remaining to achieve the 2030 Sustainable Development Goals, we must accelerate financing solutions that drive gender equality. While investor appetite for products that address social issues is growing rapidly, sustainable finance markets have struggled to keep up with demand. The guide we are launching today will help address this by making it easier for issuers to raise funds for these innovative financial instruments”.

“We hope that the public and private sectors will join us in supporting women around the world—and creating better economic outcomes for us all”.

Social Bonds, according to the Social Bond Principles (SBP), are any type of bond instrument that exclusively applies the proceeds, or an equivalent amount, to finance or re-finance, in part, or in full, new or existing eligible Social Projects that align with the four core components of the SBP: i) Use of Proceeds; ii) A Process for Project Evaluation and Selection; iii) Management of the Proceeds; and iv) Reporting. Sustainability Bonds, according to the Sustainability Bond Guidelines, are bonds that exclusively apply the proceeds to finance or re-finance a combination of both Green and Social Projects. Sustainability Bonds align with the four core components of both the Green Bond Principles (GBP) and the Social Bond Principles. The GBP is especially relevant for Green Projects, and the SBP for Social Projects. Sustainability-linked Bonds, according to the Sustainability-linked Bond Principles (SLBP), are bond instruments with financial and/or structural characteristics that depend on whether the issuer achieves predefined sustainability/environmental, social, and governance (ESG) objectives, and that align with the five core components of the SLBP: i) Selection of Key Performance Indicators (KPIs); ii) Calibration of Sustainability Performance Targets (SPTs); iii) Bond Characteristics; iv) Reporting; and, v) Verification. With these bonds, issuers commit, explicitly, to improve sustainability outcome(s) by a predefined deadline. The proceeds from SLBs are intended for general purposes, and, hence, the use of proceeds is not a determinant in its categorization. Bonds that adhere to the SBP or SLBP, and which focus exclusively on gender equality, are often referred to as gender bonds.

Image courtesy: Jordantimes.com